Bridge Insurance Brokers is expanding its claims app tech service, based on its success with the motor fleet division.

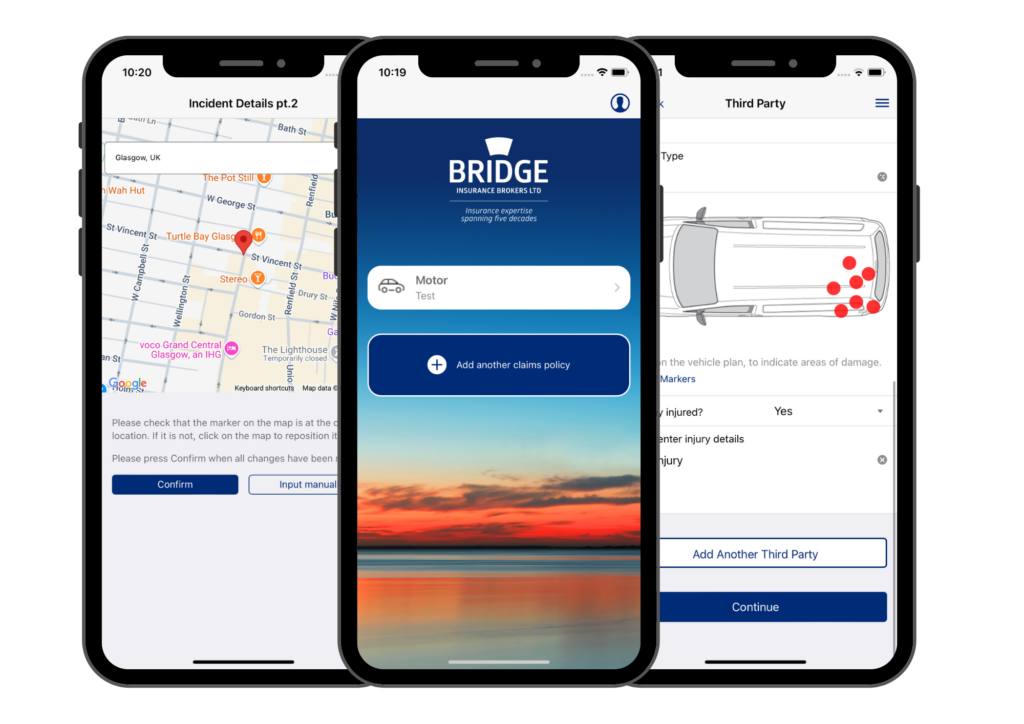

Bridge has partnered with Insure Apps, the UK’s leading claims app provider, since 2019 to provide its motor clients with a more efficient claims experience. Insure Apps is the tech provider that offers claims app technology to brokers, fleets, and businesses all over the UK, saving time and reducing costs by enabling users to report claims in minutes. The partnership means that registered Bridge clients can utilise smartphone technology by using the Bridge Insurance Claims App or access a web-based version of the accident report via the Bridge website.

Feedback has been so good that the firm is now expanding its offering to its large portfolio of property clients. Over 1,100 Bridge insurance claims have already been processed through the platform, with over 70% of claims being reported within one day of the incident. Fast reporting has resulted in average claims cost savings of more than 20%.

Tracey Ratcliffe, Head of Corporate Claims at Bridge, says: “We are always looking to provide our clients with the best possible service and this app and portal suits so many drivers, by providing a quick and reliable route to claims. Insure Apps has the same business approach as Bridge, with a like-minded desire to benefit clients through the most efficient and personal service possible. The tech is backed up by our leading claims team, who then provide a bespoke support service throughout the claim itself.”

Stephen Marshall, Managing Director at Insure Apps, says: “Our claims app technology is helping to improve First Notice of Loss (FNOL) throughout the industry. We’ve helped businesses improve their day one reporting average from 20% to 80% and we’ve increased accuracy meaning customers, drivers, business and insurers all benefit, as Bridge has seen.

“We are delighted to be partnered with Bridge Insurance Brokers, and the team has been brilliant at making the most of our claims technology. They really care about their clients and focus on the whole client journey, understanding the right levers to pull to benefit their clients. When you combine that excellent approach to service with their level of insurance expertise, and add our tech, it’s not a surprise that we have already had well over 1,100 claims with them.”

Tracey concludes: “Clients who wish to call us can still enjoy the same direct approach, as our business is all about offering the right service to every client. But in a time-pressured world, adding a tech solution to improve a service is a no-brainer. This has worked brilliantly for our motor clients, and we can see this speed and ease of use being invaluable for clients who are managing blocks of flats, as it will help them support their tenants quickly and effectively. As a first reporting tool it is already working well, so we’re delighted to be expanding it to other parts of our business.”

You can return to our news section by clicking here.